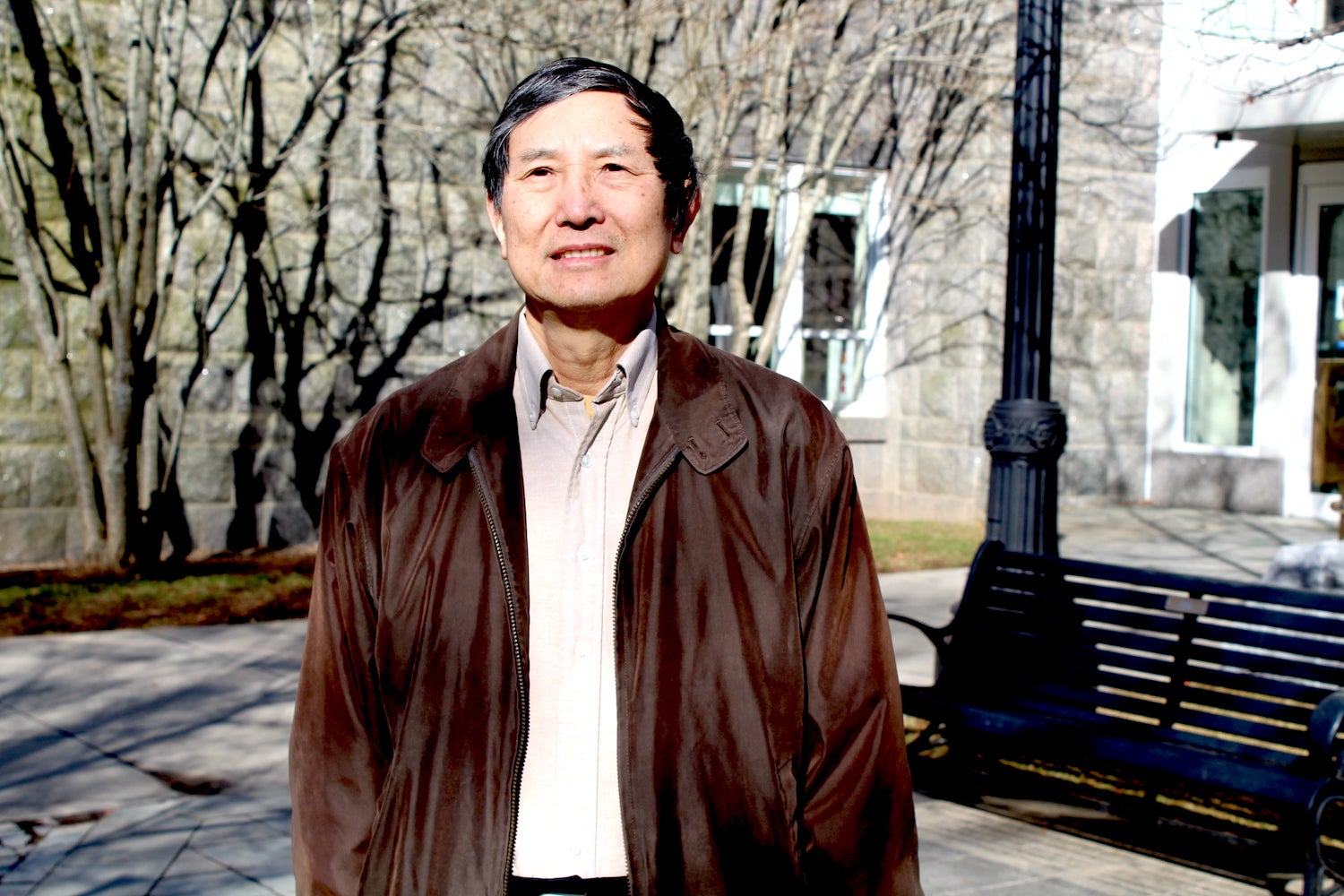

HDF Professor Jing Jian Xiao named third most ‘productive and influential’ author by the International Journal of Consumer Studies

University of Rhode Island Human Development and Family Science Professor Jing Jian Xiao has been identified as the number 3 most productive writer among educators published in the International Journal of Consumer Studies, a leading international journal in the field of multidisciplinary consumer research.

Additionally, Xiao’s study, “Consumer Financial Education and Financial Capability,” has been named the most cited paper among all journal publications over the last five years.

Xiao, an expert in consumer economics and personal finance, has successfully submitted 16 publications to the journal, covering such topics as financial literacy, budgeting, financial risk tolerance and student credit card use. He ranks as the third most “productive and influential author” among 2,722 writers who submitted work to the journal.

The International Journal of Consumer Studies (IJCS) is one of the leading research journals that publishes original, high-quality research in the field of consumer research. Topics covered in the journal include all areas of consumer studies, which consists of consumer behavior, consumer marketing and consumer psychology. Published papers are in the areas of information technology, digital marketing, services research, brand management, sustainable consumption, consumer education, and consumer economics, among others.

In addition to his work with the International Journal of Consumer Studies, Xiao is the author of such books as The Mathematics of Personal Finance, Consumer Economic Well-being, and Handbook of Consumer Finance Research. Xiao serves as the editor-in-chief of the Journal of Financial Counseling and Planning, associate editor for the International Journal of Bank Marketing and International Journal of Consumer Studies, and an editorial board member for several other journals in consumer finance.

Xiao’s research interests focus on how to help consumers increase financial literacy, perform desirable financial behaviors, and enhance financial capability to improve their financial and overall wellbeing. He teaches courses in consumer economics and personal finance in the Department of Human Development and Family Science, part of the College of Health Sciences.