As a small business owner, your secret talent is juggling. You keep multiple projects going, oversee team members, and seek out new clients and ways to grow your business all while completing your own work and keeping an eye on the business’s bottom line. While hiring a bookkeeper is something you’d like to do, it may be one of those tasks that remains perpetually on your to-do list.

Manuel Batlle, RISBDC Providence Center Director, shares why taking actions to change that is a wise move.

Here are a few of the most common reasons small business owners drag their feet when it comes to hiring a bookkeeper.

- “I don’t know how to show someone my process.”

- “I’ve been doing it this many years…why change now?”

- “My books are such a mess. I just can’t face trying to clean them up for a bookkeeper to use.”

- “Entering the financial data isn’t that big a deal. It only takes an hour or two each week.”

- “Who could I trust with my business’s finances? Hiring a bookkeeper is too nerve wracking.”

Why your small business needs a bookkeeper

There are several reasons why hiring a bookkeeper is a smart move for small business owners. First and foremost, it frees you up to focus on what you alone can do. Chances are—unless you’re an accountant—you didn’t go into business to balance the books.

Additionally, when you hire a bookkeeper, you’re giving yourself peace of mind. While there is a little bit of time and organization required on the front end to get a bookkeeper up to speed, it’s often far less than you might imagine.

For business owners who aren’t as detail oriented, having someone else handle the books is a big stress reliever. And even if you are good with details, wouldn’t you rather focus that time and attention on growing your business? Still, it’s important to know where your business stands financially all the time.

What might happen if your small business doesn’t hire a bookkeeper

Without accurate financial records it can be difficult, if not impossible, to see where your business is heading. Bookkeepers are trained to catch small mistakes that can lead to big consequences, such as running out of cash. Likewise, they’re familiar with the ins and outs of your business’s income and expenditures, making it a snap to track invoices, pay for supplies, and reconcile everything neatly for tax time.

If you choose not to hire a bookkeeper, fire won’t rain down from the sky. But you may limit your financing options, make big mistakes in pricing and costing, or make bad decisions based on bad information.

Five tips for hiring a bookkeeper

If you’re interested in hiring a bookkeeper, here are five criteria to look for:

- Good reputation. Take your time and ask for referrals. Who do other business owners you know and trust use for bookkeeping services?

- Committed to delivering timely financial information. The best information in the world doesn’t help you if it’s provided at the wrong time.

- Using up-to-date software. In a world where things are constantly changing, it’s important that your bookkeeper maintains current software.

- Availability. You want a bookkeeper that will work with you year round, even during tax season. Look for a bookkeeper that’s available from January through May of each year.

- Good Reference from a banker. Consider asking your banker whom they recommend for bookkeeping services.

We encourage small business owners to keep an eye out for these red flags as well: a bookkeeper with a small practice, lack of experience, and/or dubious reputation should be avoided.

Bookkeeper vs. CPA: Do you need both?

If you already have a CPA taking care of your taxes, you may wonder why you’d also need a bookkeeper. The biggest difference between accounting and bookkeeping is the motive behind what they do.

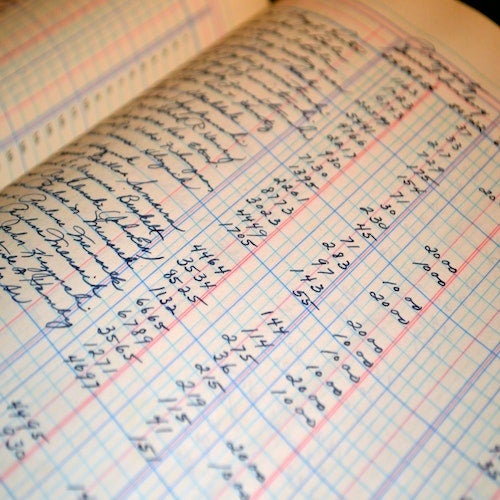

Bookkeepers are responsible for tracking every amount of money that comes into and goes out of the business. Accountants are responsible for analyzing profits and losses, and helping business owners make good financial decisions.

If you’re looking to expand, hiring employees, and doing payroll, a CPA can help with big decisions. Having a CPA is important but usually far more expensive than a bookkeeper. Bookkeepers are more involved in the day to day, keeping the records you’ll need to give to your CPA at tax time. They are also able to produce forms your business will need throughout the year and for important milestones—like getting financing.

How much should you expect to spend on a bookkeeper?

According to the U.S. Department of Labor Statistics, the median hourly rate for a bookkeeper is just over twenty dollars per hour. Rates may vary depending on the experience of the bookkeeper, their certifications, where you are located, and the type of services offered.

Is hiring a bookkeeper the smartest move for you now?

Whether you’re just starting your business or scaling it, a bookkeeper can be an important part of your small business’s growth. Take your time when hiring, however, to make sure you find a great fit.

Interested in learning more about building a healthy foundation for your small business? Be sure to check out the RISBDC’s online trainings that cover a wide variety of business topics.