FinTech

Are you ready to dive into the world of finance and technology? Join the FinTech Certificate Program or Fintech Track (BSBA) here at the URI College of Business, and unlock your potential in the exciting field of financial technology.

What is FinTech?

FinTech is revolutionizing how we think about money, investments, and beyond. It’s the fusion of finance and technology, creating innovative solutions that shape the future of financial services. URI is strategically positioned in the heart of the Atlantic FinTech corridor, and offers a unique advantage owing to its close proximity to the FinTech hubs of Boston and New York City. This geographic advantage prepares our FinTech track and certificate students for roles in a wide array of FinTech companies.

Our students have opportunities to interact with and potentially join prominent firms such as Flywire, Insurify, Kura, Kite, Lendica, Loanspark, Mitre, Monit CashQ, CollegeAidPro, Napkin Finance, Advisor360, Circle, B4B Payments, BCubeAnalytics, AbnkProv, Divizend, Fisecal, and others. We prime our students for successful careers in larger corporations including Citizens Financial Group, eMoney Financial Advisors (Fidelity), Upserve, Infosys, Marstone, and Starburst Labs. Representing just a sample of the hundreds of FinTech companies within your reach.

The FinTech Track and Fintech Certificate equips you with the skills to thrive in several areas such as banking, digital investing, and financial advising. Be part of the FinTech revolution and shape the future of finance.

Why Choose the URI FinTech Program?

- Open to students from all majors!

- Gain a solid foundation in FinTech with the latest trends, technologies, and regulations.

- Explore courses like Financial Technologies, Financial Data Analytics, Machine

- Learning for Finance, and FinTech Law.

- Discover the value propositions of FinTech companies and learn how to use, manipulate, analyze, visualize, and interpret financial data.

- No prior programming or legal knowledge is required – we’ll guide you every step of the way!

Diverse Career Opportunities in Fintech across Multiple Disciplines

Fintech values diverse skills and backgrounds, offering opportunities to students of all majors:

- BAI Students: Data scientists have many opportunities in Fintech to predict market

trends, inform business strategies, and provide actionable insights. - Accounting Students: Accounting students can find opportunities in automating

financial processes, improving data accuracy, and enhancing audit and compliance tasks. - Marketing Students: Fintech startups need marketing professionals for brand narratives, advertising campaigns, market research, and customer acquisition strategies.

- Management Students: Management students in the fintech sector can leverage

technology to improve strategic decision-making and operational efficiency. - Computer Science Students: Fintech needs software developers and IT professionals for designing, building, and maintaining digital platforms and security protocols.

- Engineering Students: Engineers can contribute to product development, process optimization, and system design, making financial services more accessible and reliable.

- Humanities Students: Fintech values skills like communication, critical thinking, and problem-solving. Roles can include customer service, human resources, and executive leadership.

- Mathematics and Statistics Students: Roles in data analysis, predictive modeling, and risk management are crucial in the FinTech industry.

- Law Students: The regulated nature of Fintech offers law students roles in compliance, contract drafting and reviewing, and keeping up with financial law.

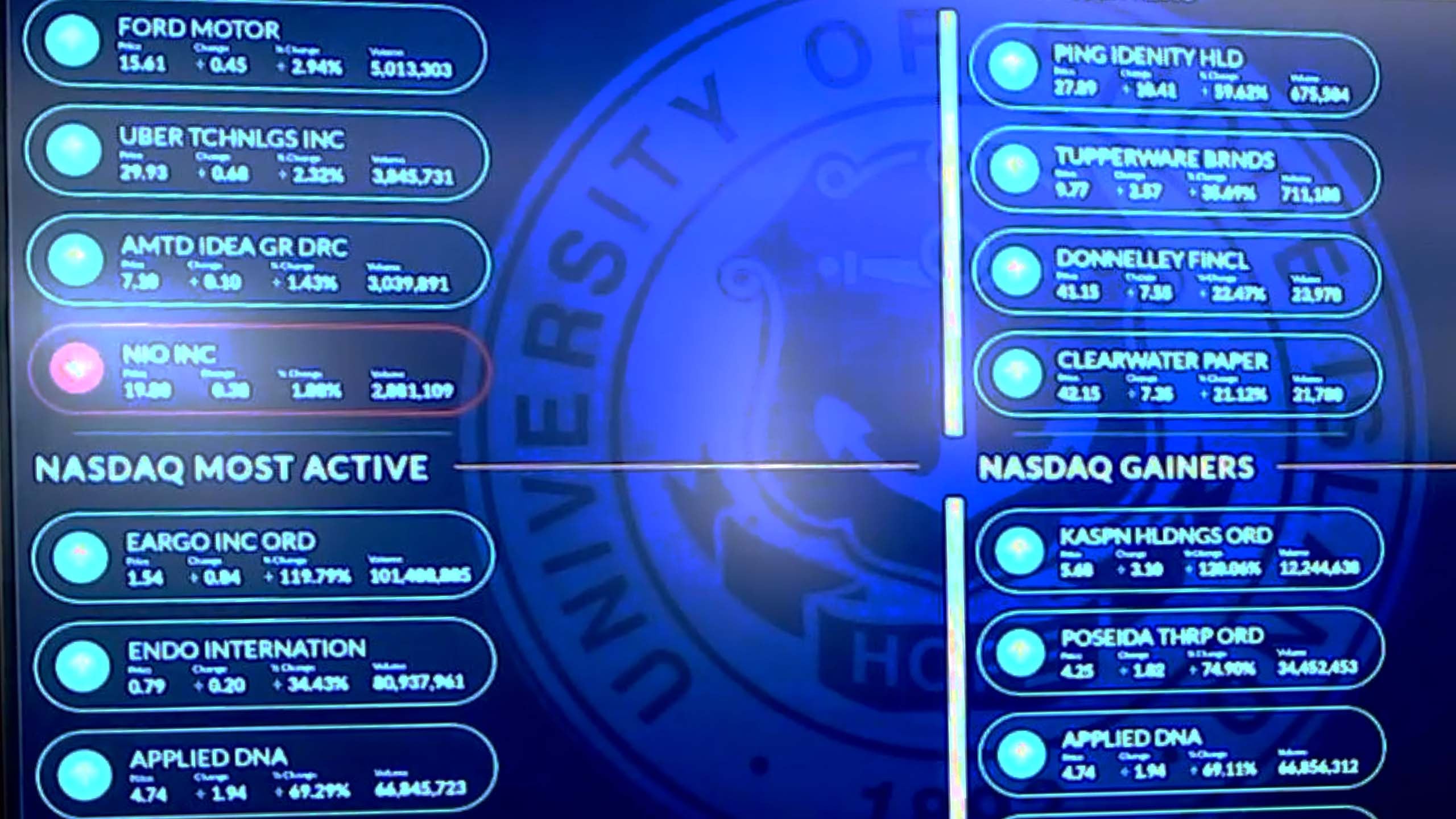

FinTech in the news