Running a small business means keeping an eye on key metrics for small business success. These metrics show how well your business is doing financially and operationally. Tracking them helps business owners make wise decisions, fix problems, and plan for growth. The right key metrics for small business operations provide insights into profitability, efficiency, and sustainability. Here are five critical key metrics for small businesses, explained in detail.

Net Profit Margin

Why It Matters: This metric shows how much profit your business makes after paying all expenses, taxes, and interest. It tells you if your business is truly making money and is crucial for long-term success.

Calculation: (Net Income ÷ Revenue) × 100

What to Do: If your net profit margin is falling, look for ways to cut costs or increase prices. Analyze your expenses to identify savings, such as reducing overhead costs or renegotiating supplier contracts. Increasing revenue through strategic marketing campaigns or expanding your product line can also improve this key metric for small business profitability.

Gross Profit Margin

Why It Matters: Track gross profit margin to measure how well your business manages the cost of producing products or providing services. This key metric is essential for determining the right product and service pricing.

Calculation: ((Revenue – Cost of Goods Sold (COGS)) ÷ Revenue) × 100

What to Do: A low gross profit margin means high costs. Negotiate better prices with suppliers, reduce waste, and improve operational efficiency. Implementing cost-saving technology or streamlining production processes can enhance this key metric for small business efficiency.

Operating Cash Flow

Why It Matters: Measuring how much cash your business generates from daily operations so you can cover bills is a must. And this is the metric that does it. Positive operating cash flow shows financial stability.

Calculation: Cash from Operations – Operating Expenses

What to Do: If cash flow is negative, improve payment collection by shortening payment terms, submitting timely invoices, and following up on overdue accounts. Reduce inventory costs by optimizing stock levels and managing expenses more efficiently to strengthen this key metric for small business cash management.

Customer Acquisition Cost (CAC)

Why It Matters: CAC shows the cost of gaining new customers. Keeping this cost low is vital for profit, especially small businesses with limited budgets.

Calculation: (Sales and Marketing Costs ÷ New Customers)

What to Do: If your CAC is too high, use cost-effective marketing strategies like social media, email campaigns, and referral programs. Improving your website’s conversion rate and leveraging organic SEO strategies can reduce CAC, making this a key metric for small business growth.

Current Ratio

Why It Matters: This metric shows whether your business can pay its short-term bills. A healthy current ratio shows that your business can handle unexpected expenses.

Calculation: (Current Assets ÷ Current Liabilities)

What to Do: If your ratio is below 1, improve cash flow by collecting receivables faster, reducing short-term debt, and maintaining adequate cash reserves. Monitoring this key metric for small business liquidity ensures preparation for financial challenges.

Benchmarking Key Metrics for Small Business

Use Industry Data: Tools like IBISWorld, Statista, and QuickBooks provide data to compare your key metrics with others in your industry.

Join Groups: Participate in SCORE, business chambers, or industry forums for valuable insights and peer support.

Track Trends: Adjust key metrics for small businesses based on seasonality, market conditions, and economic changes.

Get Expert Help: Work with financial advisors, accountants, or consultants to analyze your key metrics and develop strategies. The Rhode Island Small Business Development Center (RISBDC) provides one-on-one support to assist you.

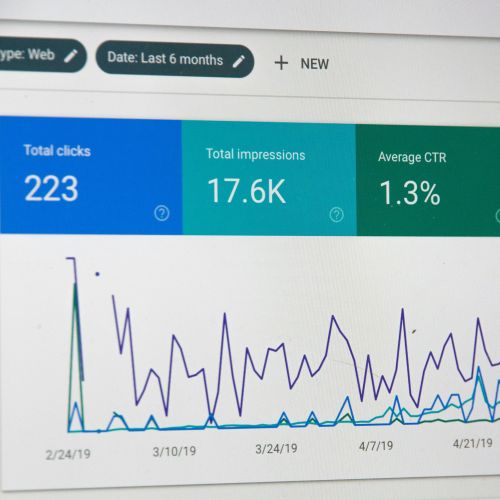

Use Tech Tools: Track key metrics for small businesses with software like Xero, Zoho Books, Google Data Studio, or QuickBooks for accurate, real-time analysis.

Why Key Metrics for Small Business Matter

Tracking key metrics for small businesses helps you to identify growth opportunities, avoid potential risks, and remain competitive in today’s rapidly changing market. Regularly reviewing these metrics keeps you informed and ready to make strategic adjustments. Focusing on key metrics for small business financial health, operational efficiency, and customer acquisition builds a strong foundation for long-term success.

Contact the RISBDC today to schedule a consultation. We’ll provide personalized advice and tools to help you start or grow your business.